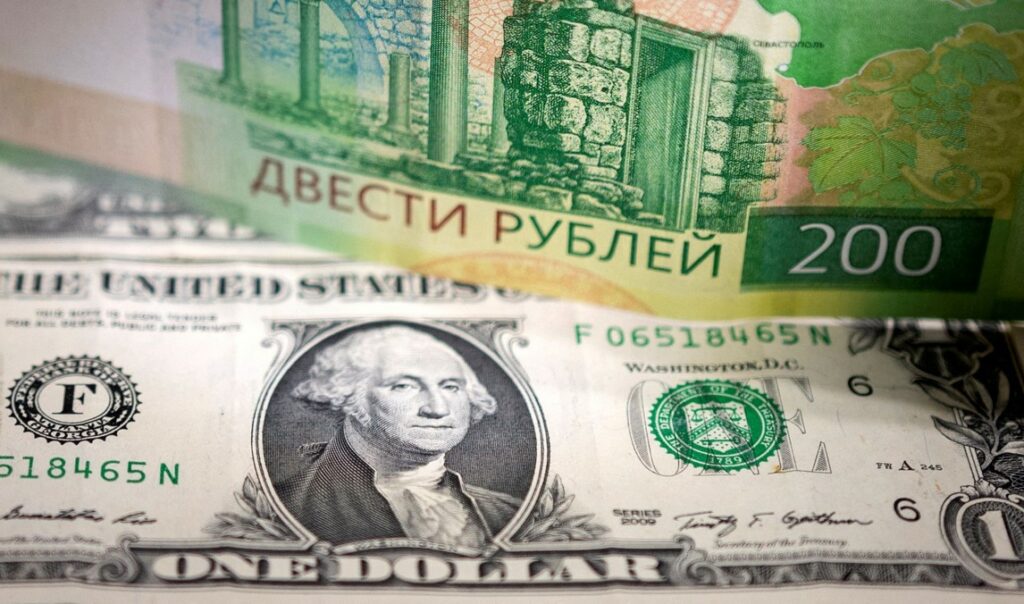

Putin Sets the Record Straight: Russia Denies Role in Dollar Decline

Russian President Vladimir Putin addressed the potential decline of the U.S. dollar’s dominance.

Putin made it clear that Russia has no intention of de-dollarizing its economy, stating, “We have never had and do not have the goal of de-dollarization.” However, he highlighted global economic shifts, including China’s rise and the decreasing reliance on the dollar in settlements.

While acknowledging America’s strong economy, Putin criticized the political leadership for misusing the trust of the American people. He also raised concerns about the U.S. government weaponizing the dollar, which has sparked doubts about its reliability for world trade and reserves. Putin pointed out that major economies are gradually reducing their dollar reserves and shifting towards settlements in other currencies such as the euro, yuan, and national currencies.

Moreover, Putin noted the emergence of ideas and projects for creating regional or national currencies, indicating a growing trend away from the dollar. He emphasized that Russia is not responsible for this shift and emphasized that if the trend gains momentum and more exchanges start bypassing the dollar, it could mark “the beginning of the end for the dollar.”

In conclusion, Putin criticized the American political elites, suggesting that their actions are contributing to the negative consequences faced by the dollar. He reiterated his belief in the intensification of the multipolarity trend, warning that those who fail to adapt may face significant losses.

As the debate surrounding the future of the dollar continues, Putin’s perspective adds a dash of intrigue to the evolving global financial landscape.

Clever Robot News Desk 19th June 2023