Cryptocurrency

Cryptocurrency may not have a physical form, but it stores value like real currency. To make cryptocurrencies more accessible and secure, they are formed on blockchain and secured with cryptography. This is where the term “cryptocurrency” was coined from. The process of cryptography makes these currencies decentralized, i.e., not dependent on any institutions and work independently. Bitcoin was the first ever cryptocurrency to be created. However, over the years, many more promising players have emerged. Cryptocurrency was primarily used for storing value. Later, with smart contracts, they were put into multiple uses like swapping, staking, holding, lending, etc. This smart contract also enables independent task executions, which makes them more futuristic.

Table of Contents

Blockchain

Blockchain, on a simple basis, can be termed as a transparent public ledger that holds all kinds of transactions.

All the data entering the blockchain is stored in blocks. To store additional data, further blocks are added to the chain, which is why it’s called a blockchain. The very first block, called Block 0, is developed by a blockchain developer, and further blocks are developed by miners.

To ensure all the data in the blockchain are legit, all the nodes come together to validate and verify them. In case of any fraudulent activities, they can be easily identified. Miners are also responsible for nodes that manage the block, which forms a large peerto-peer network.

Smart Contracts

Ethereum is the second most valued cryptocurrency. Though it works similar to bitcoin, the introduction of the smart contract has made it

more diverse.

In simple terms, smart contracts execute themselves after certain conditions are met. They compare real-world data with the help of oracle nodes to execute the tasks seamlessly.

The biggest advantage of smart contracts is that they are immutable. Once the contract is deployed, no one can change or edit the conditions, which makes it difficult to tamper with.

Many noteworthy projects have been introduced because of these smart contracts, which scale up blockchain technology. Many other blockchains have also been introduced with the concept of using smart contracts in mind.

Usage of smart contracts

A smart contract makes the decentralized network more automatic, secure, trustable, and fast. These smart contracts are majorly used in:

• Financial transactions

• Insurance

• Token swapping

• Asset buying

• Deployment of DApps

and many more areas.

Consensus Mechanisms

The consensus mechanism is what runs the blockchain networks and helps them be secure and transparent. It helps the nodes to come to a universally accepted rule on the blockchain.

There are many types of consensus mechanisms, but only two are widely used:

- Proof of work- PoW or Proof of work is the first consensus mechanism created that works on bitcoin. Many nodes come together to solve a mathematical

computation to add new transactions to the blockchain. The one who solves them earns a reward. This process of adding the transactions is called mining, and

the nodes who perform this are called miners. Due to PoW’s collective computation nature, more energy is wasted, acting as a major drawback of the PoW mechanism. - Proof of stake- To solve the issue of major energy consumption for PoW, Proof of stake or PoS was introduced. Instead of involving many nodes to work toward solving the computations, a single node takes over the responsibility by staking a few coins. The one who stakes higher can work on the computation and is rewarded later. This process of adding the transactions is called “validating,” and the nodes who do this are called validators. Due to this process, PoS energy consumption is lower compared to the PoW mechanism and is inexpensive as well. This is why many 3rd and 4th gen blockchains use the PoS mechanism.

Coins vs. Tokens

Coins and tokens may be one of the most confusing terms for all beginners, but we’re here to simplify it for you: Both coins and tokens represent the value of something. They have many similarities like similar fundamentals, which help in processing payments and swapping for other tokens or coins. But coins and tokens are totally different.

There are no limitations for coins, but tokens are only usable sometimes. What makes them different is what they are built on. Coins are used on their own blockchains, whereas tokens are built on another blockchain.

For example, ETH is a coin as it is built to support the Ethereum blockchain, whereas LINK is a token of Chainlink, which uses the Ethereum Blockchain

Altcoins

Coins other than bitcoin are called altcoins. These can also be considered the alternatives to Bitcoins, as most altcoins are forked from bitcoin.

Due to the massive success of Bitcoin, other cryptocurrencies have been created with few changes to Bitcoin codes. According to Statista, as of 2022, there are more than 10,000 altcoins.

Types of Cryptocurrencies

Coming back to cryptocurrencies, the types of cryptocurrencies can be derived based on the value they serve. Three types of cryptocurrencies have had a prominent use so far:

- Security coin – A security token, also called a security coin, is an equity or assetbacked token that is governed by financial regulation. For example, BCAP (Blockchain Capital).

- Utility coin – It is also called a utility token. Utility tokens enable users to access certain services by the issuer. For example, BAT (Basic Attention Token) users can earn/give tips and access gift cards.

- Stablecoin – Stablecoins are coins that represent fiat currencies. Their value is pegged to fiat currencies like USD. For example, USDT (TetherUS).

Crypto Wallets

Just like physical wallets store fiat money, these digital and fully decentralized wallets store cryptocurrencies. They consist of two keys, a public key that is sharable and a private key that should not be shared. By sharing your public key, you can receive funds from others.

To make these wallets secure, a private key that consists of a seed phrase is created for every wallet so that no hackers can get access to your wallets and tamper with your funds. These seed phrases should be secured as losing the private key can lead to loss of funds.

Three types of Crypto wallets are used to store cryptos:

- Software wallets- These are online-based wallets. Centralized exchanges (CEXs) and decentralized exchanges (DEXs) usually contain these types of wallets, like Binance wallets. Both private and public keys are stored in these for users’ easy access. This is also a type of cold wallet.

- Hardware wallets- These are offline wallets. They have a physical form, mostly like USB sticks with buttons to navigate. You can access your funds once they are connected online. Though they are very secure, they are quite expensive compared to other wallets. Hardware wallets are a type of cold wallet as it is only usable when connected to a computer.

- Paper wallets- Paper wallets are in the form of a QR code printed on paper. They contain the information of your private key and public key. They are safe as they are not prone to hacks but are easily destroyable.

Crypto Exchanges

Crypto exchanges enable the process of trading and swapping crypto easily. As they are tradable 24/7, anyone across the globe can trade funds whenever needed. Most cryptocurrencies support all the major coins, while some exchanges like Binance and Kucoin support 150+ coins.

Most of the noteworthy crypto exchanges are centralized, but the usage of DEXs has also seen an increase in recent days. Some of the prominent CEXs are Coinbase, Binance, and Kucoin. DEXs like Uniswap, Pancake Swap, and Curve have been gaining more attention in the past year.

Top 10 Cryptocurrencies in the Market

Currently, more than 12,000 cryptocurrencies exist in the market. Not every currency has a successful scope, though. Major currencies that are listed in all of the cryptocurrencies have a great benefit in the long term.

Here are the top 10 cryptocurrencies based on the market cap as of August 2022 which have a large potential to grow in the future:

- Bitcoin (BTC) – Bitcoin is the first ever known cryptocurrency that is still leading the market. It was started by Satoshi Nakamoto after he submitted a whitepaper during the 2008 financial crisis. It was implemented in 2009. From then on, many currencies have evolved in the market. Bitcoin has become the pioneer, with its market cap reaching $1 billion in April 2021.

- Ethereum (ETH) – Ethereum was co-founded by Vitalik Buterin, who started with Bitcoin. Once he understood the limitations of Bitcoin, he created Ethereum with the inclusion of smart contracts. Because of the diverse nature of smart contracts, Ethereum became the second most valued cryptocurrency after Bitcoin. In mid2016, due to the DAO attack and losing millions of Ether, Ethereum was split into two, Ethereum Classic and a new Ethereum (with a forked version). Since the fork, Ethereum has grown massively.

- Tether (USDT) – Tether can be considered one of the prominent stable coins which are pegged to USD. This means the price of the currency redeems itself along with the USD. Though it was launched as “Real coin” in July 2014, it was rebranded as Tether. With a market cap of around $65 billion, Tether and other stable coins are used in DEXs to avoid additional fees. This comes in handy for traders who are actively trading cryptocurrencies.

- USD Coin (USDC) – USD coin is a fiat collateralized stablecoin and is pegged to USD. It was developed by the Centre Consortium and Coinbase teams in 2018. The circle teams aim for every USDC minted to be backed with a dollar held in reserve. On March 29, 2021, Visa stated that transactions can now be settled with USDC on their network.

- BNB – Binance blockchain is home to BNB coins. Though Binance started as a CEX, they built their own blockchain with the coin BNB. These coins are primarily

used in the Binance smart chain to pay for fees in the Binance exchange. However, they are also used for other things, such as card payments for cryptopayment gateways on BNB-friendly websites. In addition, they can be used for charity and lent to earn interest. - Ripple (XRP) – Ripple Labs created XRP to act as a bridge between fiat and cryptocurrencies. With the help of IOU tokens, companies can make many transactions simply and cost-effectively. The XRP is meant to make Ripple Labs’ projects easier, making it more of a private blockchain.

- Binance USD (BUSD) – This is another stablecoin by Binance, which is backed by fiat currencies. It was founded by Binance and Paxos. These coins are regulated by New York state regulators, where 1 BUSD is equal to 1 USD. Paxos conducts regular audits to ensure the value of USD and BUSD remains the same.

- Cardano (ADA) – ADA works on a PoS consensus mechanism. Their blockchain is similar to Ethereum, but the founder, Charles Hockinson, focuses on the linear scaling method to speed up the increase in transactions and interoperability. They are also focused on improving scalability via a layered architecture. This itself gained an important place in cryptocurrency for Cardano.

- Solana (SOL) – Solana is one of the few blockchains that are considered equal to Ethereum as a majority of the functions are similar to Ethereum. The biggest flex for Solana is its quickness and cost-effectiveness. Solana uses the proof of history mechanism, which is similar to the PoS stake but with the addition of time stamps. This makes the transaction and verification processes faster. Though they have faced many attacks in the past years, the teams are also constantly working on upgrades. Despite this, Solana still stands as the ninth largest crypto because of its continuous growth.

- ogecoin (DOGE) – Dogecoin is the first ever created meme coin. Doge was created based on Litecoin and is also considered an altcoin. Though it started as a joke to mock crypto hype, it soon rose to popularity.

Few other strong players have a long-term future in the crypto market. Some notable players worth the hype are Polkadot, Polygon, Avalanche, Shiba Inu, Uniswap, etc.

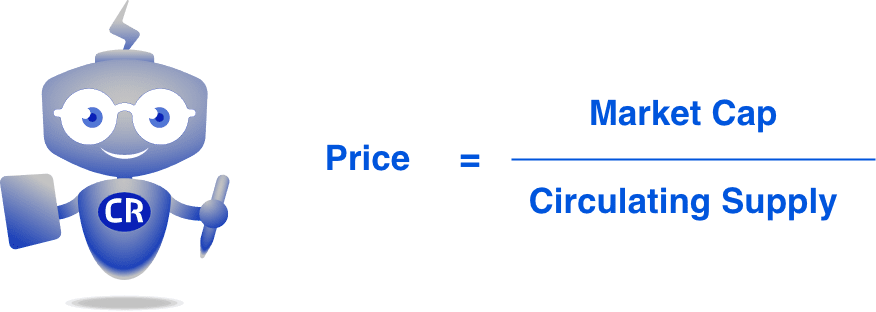

Pricing Cryptocurrency

The prices of cryptocurrencies are extremely volatile and are closely monitored by every trader. The prices of each currency are determined through the total market cap by circulating supply. However, they are also influenced by a few other factors, such as supply, power, and demand.

Governments’ Stand on Cryptocurrencies

Owing to cryptos’ very new nature, there are times when governments have been in a dilemma about how they will be beneficial to the economy. Nevertheless, we can slowly see that some countries are favoring cryptocurrency usage gradually.

Along with cryptocurrencies, governments are also welcoming other web3 technologies like Metaverse. Some government measures that are positively leaning towards cryptocurrencies are:

- US governments are keen on regulating cryptos in the future. Federal Reserve Chairman Jerome Powell July mentioned that Fed is showing an interest in regulating Stablecoins, and they might possibly become a central bank digital currency.

- Indian Finance minister Nirmala Sitharaman, during the 2022 Indian budget announcement, mentioned that taxes were levied on crypto profits, indicating a positive action from the government

- El Salvador has officially announced bitcoin as a legal tender currency by proposing a bill in June of 2021, which was approved after a couple of months.